The IOWA student loan: Types of Loans and its features, Eligibility criteria full details login 2024 at https://www.iowastudentloan.org.

Iowa Student Loan

Education is quite expensive, though valuable in the long run. Students require to have finances which can support them until they complete their education and get into the career industry. However, after exhausting the financial aid and other scholarship programs, many students opt for private student’s loans to help them complete their education. Getting the right private loan with suitable features and deals is quite challenging.

However, students can stop the search as they can settle for significant organizations such as Iowa student loan. Iowa is a non-profit organization which helps families and students with resources to complete their postsecondary education. The organization offers more than just student loans and scholarships but provides students with planning tools and resources. The organization has supported more than 400,000 students with their college education.

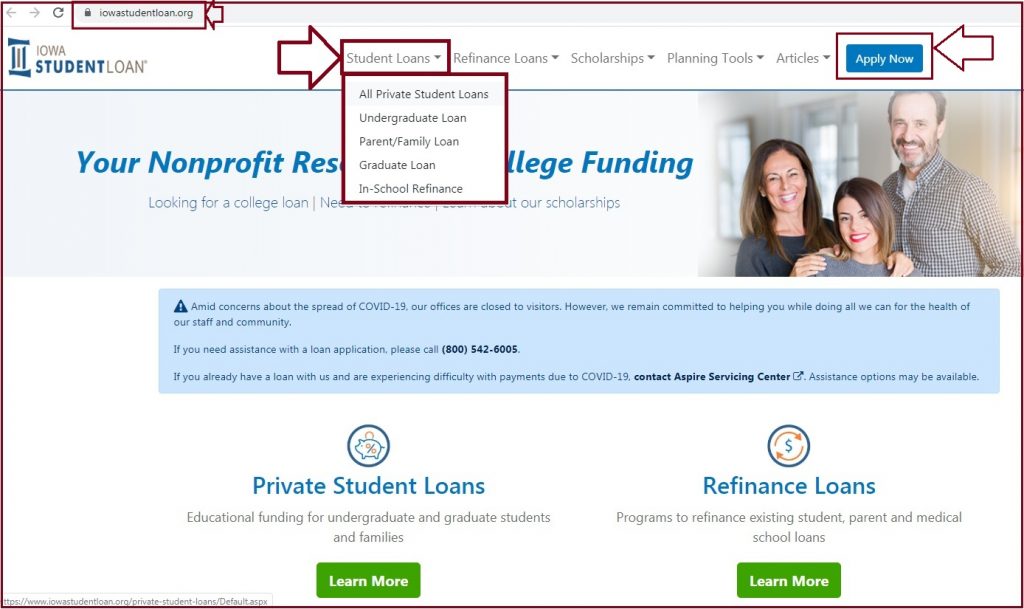

Iowastudentloan.org

Types of Lowa Student Loans

The loan is flexible as the organization helps current students and families or parents who need to educate their children. They also help student with refinancing loans to pay their existing student loans. The Iowa organization offers only two types of loans.

- Partnership loan

- College family loan.

The two loans have different terms and conditions according to what suits the student best.

IOWA Partnership Loan

These type of loan is offered to students who are want to fund their college education. The student can apply for the loans whether they are attending the Iowa college or other colleges in the state. The Iowa student loan has eligibility criteria which will determine whether you qualify for the loan. In case the student doesn’t qualify, they need to have a consigner to help them get the student loan.

IOWA College Family Loan

These type of loan works more like a federal PLUS loan; it is based or created for parents and family members who need a loan for their children’s education. The loan doesn’t have an origination fee and late payment fee. The college family loan is flexible as it is available for friends and family members.

Eligibility Criteria

The Iowa student loans have different eligibility criteria according to the loan as follows:

Iowa Partnership Loan

- The student should be of the right age to apply for the loan if they aren’t of the set age by the organization they need to have consigner to qualify.

- One should be an American citizen or permanent resident of the US with legal documents to proof. For a student using the consigner, they have to be permanent residents of the US or American citizen.

- The student should be enrolled in a college or university by the time of application and show proper academic progress.

- Not have any defaulted records for private or public loans.

- Student using the consigner to qualify to need the following:

- A minimum FICO score of 670

- Have continuous employment record of 2 years unless they are disabled or retired.

- Have no bad records of defaulting loans or taxes etc.

IOWA College Family Loan

- The applicant should of the set age by the Iowa student loan organization.

- They should be American citizens, or permanent residents in the US same goes for the consigner.

- Have a minimum of 670 FICO scores.

- They should show proper records of employment history.

- Now defaulting history from other student loan organizations or defaulting on paying their taxes, credit providers etc.

- The student should be already enroll in a college or university with good academic progress.

Note Iowa student loan provides a minimum of $1,001 for both types of loans and a maximum of $80,000 for all students in need of the loan. Student can pay through three options which are:

- Immediate payment: this is a regular payment which helps lower the interest rates. The loan has a stretched period of 10 years.

- Interest-only payment: this type of loan of starts paying the loan immediately is sent to the student’s account. It helps reduce the loan balance and interest; the loan is payable with ten years.

- Deferred payments: these payment method is done when a student postpones to pay the loan while in school and start paying six months after one graduates it has a payment period of 15 years.

The Iowa student loans have a 0.25% discount on the interest if they sign up for autopay. These apply for all loans provided by the organization.