The Wells fargo student loan login: Wells Fargo Student Loan online application 2024, Eligibility criteria at https://www.wellsfargo.com/student

Wells Fargo Student Loan

The cost of education is rising, making it difficult for students to pursue further. The students are opting for student loans to complete their education, which they pay according to lenders’ terms. In most cases, some students land in harsh lenders’ hands where they pay higher interest rates, which is burdening.

However, there are several or few bodies which offer better student loans deals such as Wells Fargo. This is one of the largest Banks in the US and the best private student loan lending facility. It was established 160 years ago and offers various financial products such as bank account, mortgages, and student loans.

Wells Fargo Student Loan Login

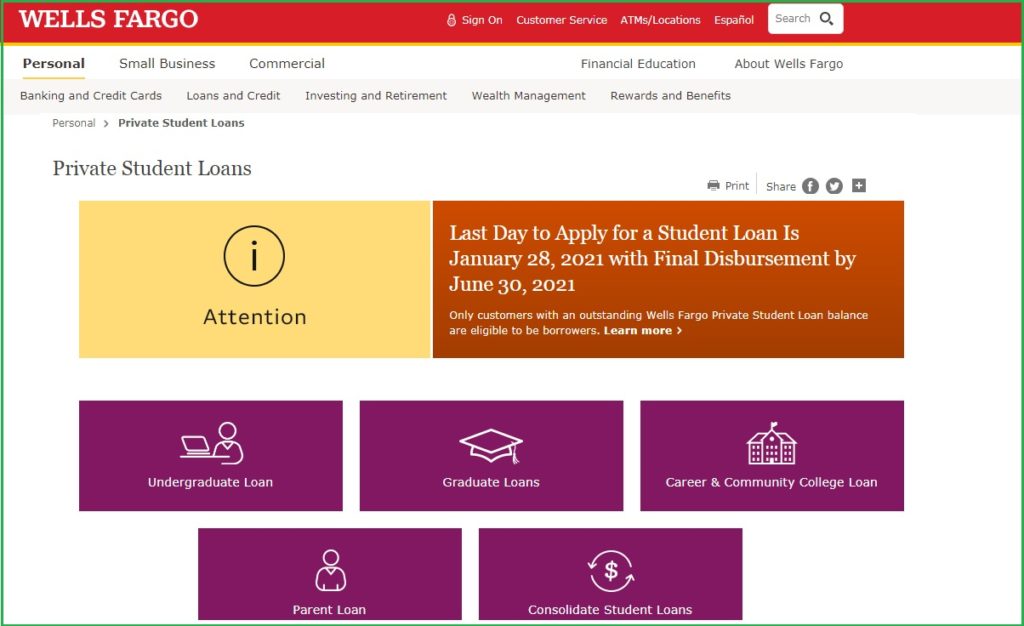

Types of Student Loans From Wells Fargo

Wells Fargo provides eight student loan programs, from a total of five of the loans aim to help students cater to their educational expenses. Two of the student loans fund help cover student’s post-graduation expenses (health and law students). The last student loan helps student consolidate their student loans.

Career and community college

The loan is offered to students attending two-year schools, career-training programs, and non- traditional schools.

Undergraduate student loans

The loan applies to students pursuing undergraduate courses.

Parent

These a loan for credit worth adults who don’t have to be parents but can borrow funds to educate their student/child or relative who is a student.

Graduate

Applies for students seeking a graduate degree.

Health professions

These a graduate degree loan for students pursuing health professional, the loan covers different health-related courses.

Post-medical school loan

The loan helps medical students cater to living expenses, exam costs, or review courses while studying for medical boards and clinical exams.

Bar exam

Law school graduates and students can borrow money to pay for registration, review courses, and living expenses while studying for the bar exam. (Only for final year student)

Consolidation loan

Students can pay other private student loans using the Wells Fargo loan.

Eligibility Criteria of Wells Fargo Student Loan

Wells Fargo allows borrowers who have a favorable credit score of 761 for both borrower and cosigner. The applicant should be a permanent US resident or citizen. However, non-US citizens can apply if the cosigner is a US citizen or permanent resident. The body requires foreigners to provide more documents for verification. Applicants should also be 18 years and above during the time of application for types of loans. The institution should be recognized for the student to qualify for the Wells Fargo student loans.

Application: What to Expect

The application process is almost the same for the applicants but not the cosigner. The first page is the same for all types of student loans. Wells Fargo’s loans application form has four steps:

- Completing the application

- Submitting the supporting documents

- Signing the loan

- Receiving the loan.

- During application select the type of loan (you can read the above examples)

- Enter your school, and student information enters details on the online web by clicking students then find the school based on state and name. Enter the first letters of the name, if it doesn’t appear on the list. It means Wells Fargo doesn’t provide loans for that particular school.

- Choose the grade level in which the loan will cover the field of study and your citizenship status.

- Your student loan page: here, the system will tell you whether you qualify for the student loan type you selected. They may suggest a different loan or provide information about what you can do.

Wells Fargo Student Loan Application 2024 Process

- Visit wells fargo student loan login portal at https://www.wellsfargo.com/student

- Enter your personal information: name, residence, social security number, date of birth, and contact number.

- Students will Well, Fargo online account can log indirectly, and the information will be added automatically.

- Next on the second page enter the following details:

- The contact information like phone number, email address home address, and how long you have lived at the address you provided.

- Employment history: enter information on your income share the company’s name, city-state contact number, etc.

- Loan information

- Any additional people such as cosigner.

- Confirm the documents check whether they are readable before submitting.

- The final step is disclosure.