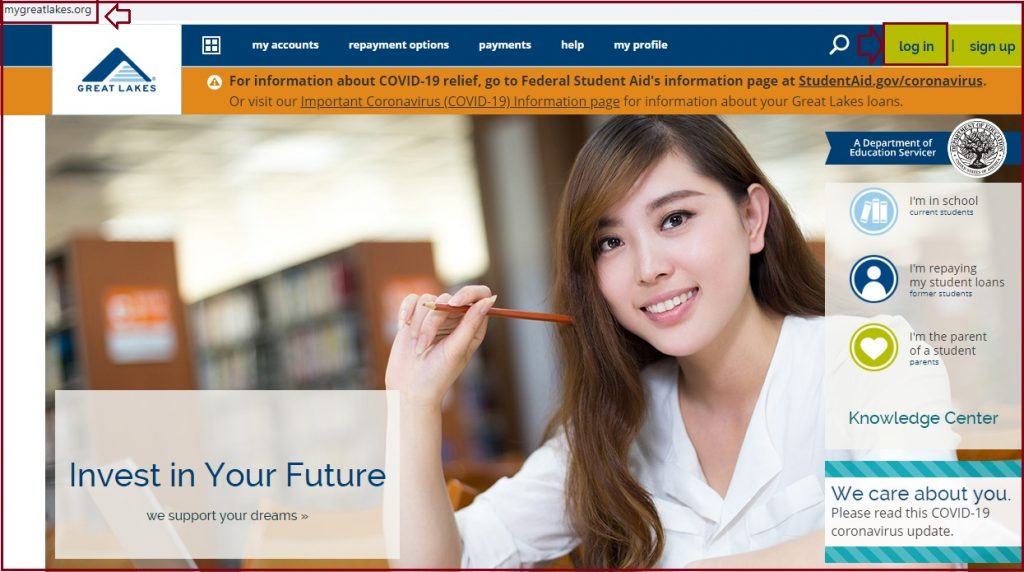

The Mygreatlakes | The Great Lakes Higher Education Corporation at mygreatlakes.org

Mygreatlakes

Education is considered as basic need meaning its essential for everyone to get some to manoeuvre in life. However, education takes most of the financial income since the most institution of privatized education. These deter many from pursuing higher education living with basic or no education. To curb these problems, several organizations offer scholarships and student loans.

Many students take advantage of the loans and complete their education only to find it difficult to pay back. However, the loan institutes have several ways of retrieving their money and helping more students. The Great Lakes is among the best and largest student loan providers and guarantor in the United States. The corporation is a non-profit and is among the four best companies dealing with United states federal students loans. The company later sold the part of the organization that offered loans to a new company Nelnet.

Applying for consolidation at Mygreatlakes

A student with multiple loans and servicers might find it difficult to manage the loan. However, the US education department gave all students with loans to choose a consolidation servicer. The great lakes are one of the renown servicers which students can select.

- Prepare and apply for the consolidation loan; have the application ahead of time. The process takes 30 minutes, and you’re done filling personal details.

- Have a repayment plan for your loan; students can check some of the great lakes repayment plans and use some on the application form. Note some plans require student’s requirements to help pay for the loan.

- Use the online process for the application process; you should enter the details fast as one session has 30 minutes and cannot be saved if you leave the page.

- Now select the consolidation servicer for the list given by the education department which includes great lakes. Now you can complete the process and wait for the results.

- Students can track their application though the corporation (great lakes) always communicates after one or two business days. one can check the status from the official great lakes website portal www.mygreatlakes.org

- The student will receive information on:

- If the application is received

- if the student needs to take any action,

- when the process is complete.

How to help a student pay their mygreatlakes loans?

Parents and the Institution should help the student learn how they can repay their loans once they clear from school. Parents can offer the following tips:

Counselling on completing exit

students are required to take student loan exit counselling; this helps students know everything about the loan payments. They can survey different plans and the options which are there if they cannot pay the loans. Parents can encourage students to complete to know the difference between normal loans and student loans.

- Help student understands the loan is real, and they will pay after they are done with school. They should learn the money comes with interest so they should borrow what they need and not beyond that.

- Teach students who they owe (great lakes) and how much: students should know who they have to pay and how much they should give on every instalment.

- The student should keep all records students are offered a grace period once they graduate. Here they should learn the grace period time not to expire before they plan on how to pay.

- To ease the payment students can sign up for automatic payments, the auto pay is best as they can manage their finances. The great lakes have an automatic payment method which student can implement on the accounts.

- Students can learn the options in case they don’t have an income after the grace period. They can postpone the loan data or seek loan forgiveness.